Scotland's Economy

State of the Economy Report

November 23, 2012 by Dr Gary Gillespie No Comments | Category Economy

This State of the Economy Report comes four years after the height of the financial crisis in autumn 2008.

At that time, most forecasters predicted that the world’s major economies would experience a sharp – but relatively short – recession.

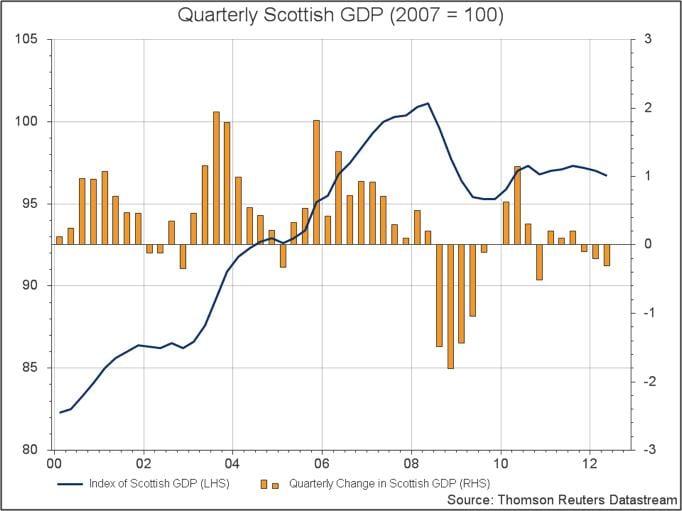

Four years on however, it is clear that this prediction has been wide of the mark. While the depth of the recession was slightly deeper than most people expected, what has been most surprising has been the extremely slow recovery.

Scottish output remains 4.4 per cent below its pre-recession level and around 15 per cent below what it would have been had the economy continued to grow at its long-term trend.

Recent Global Economic Developments

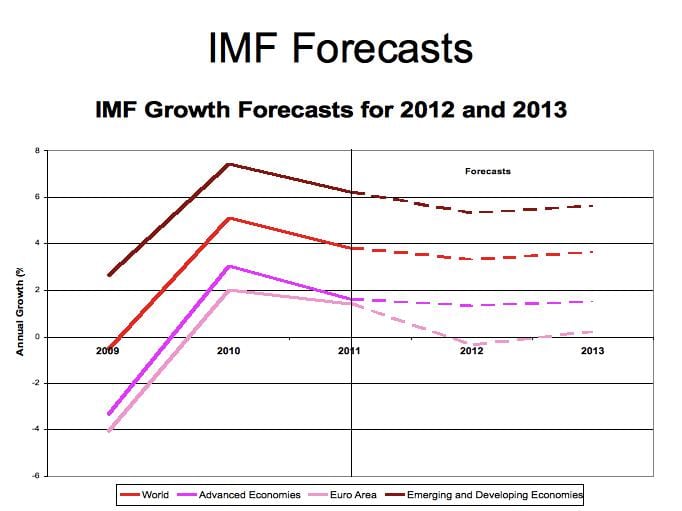

This year, the global recovery has weakened with forecasts being revised down in both advanced and emerging economies.

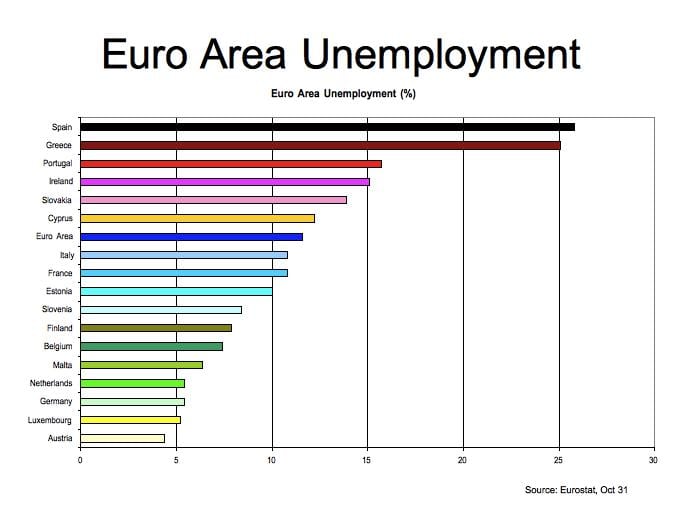

The economy of the Euro Area, which has re-entered recession, remains the key area of risk for the global recovery at the current time. While some progress has been made toward introducing the reforms that many believe will be crucial to the long-term success of the European model – for example recent steps toward establishing a ‘banking union’ – the outlook for many European economies remains extremely challenging.

Whilst it is encouraging that the UK economy returned to growth in Q3, the consensus view is that underlying GDP growth remains flat. Output is likely to continue to zig-zag through the remainder of 2012 and into 2013 – most economists predicting a fall back in growth in Q4 2012 with even the possibility of a modest contraction. The Bank of England for example, forecast that the UK will experience close to zero or slightly negative growth in the final quarter of the year.

Whilst it is encouraging that the UK economy returned to growth in Q3, the consensus view is that underlying GDP growth remains flat. Output is likely to continue to zig-zag through the remainder of 2012 and into 2013 – most economists predicting a fall back in growth in Q4 2012 with even the possibility of a modest contraction. The Bank of England for example, forecast that the UK will experience close to zero or slightly negative growth in the final quarter of the year.

Recent Scottish Economic Developments

The recovery in Scotland remains fragile with overall output falling 0.4 per cent in Q2 2012 following a total fall of 0.3 per cent in the preceding two quarters. A zig-zag pattern of growth is also likely to continue in the Scottish economy in the short-term

While the UK and Scottish labour markets have held-up relatively better than envisaged at the start of the crisis (giving rise to the so-called productivity puzzle), rates of unemployment remain well above trend.

Future Prospects – Global Economy

The fragility of the global recovery, evident through 2012, is forecast to continue into 2013 though the outlook is more positive for next year than this.

In my view, the two key challenges remain the Euro Area crisis and deleveraging by households, government and the financial sector.

There are some signs for optimism however; the US economy has proved to be relatively resilient and it is possible that a pick-up in the world’s largest economy, coupled with continued growth in emerging economies, could help lift confidence around the world. The deleveraging process will also continue to recede in the UK, with the recent fall in inflation also helping to boost household income.

Future Prospects – Scottish Economy

As an open economy, Scotlandwill continue to be influenced by the performance of key trading partners. With 80 per cent of Scottish exports destined for the combined UK and EU markets, a strong recovery in these economies is key.

I still expect the Scottish economy to return to near trend growth in 2014 as well as returning to pre-recession levels of output that year. However, this will depend on the developments in the Euro and a continued improvement in both the global outlook and confidence in domestic markets. There clearly remain risks on both the up and downside.

Tags: Euro Area, financial crisis, GDP growth, state of the economy

Leave a comment