Digital

ScotPayments: Confirmation of Payee – Driving Efficiency and Fraud Prevention

December 8, 2025 by Stewart Hamilton No Comments | Category Digital Scotland, ScotPayments

Blog by ScotPayments’ Raven Green, Senior Digital Portfolio Manager and Megan Abbott, Lead Business Relationship Manager.

Last year, we wrote about the launch of Confirmation of Payee (CoP), a simple but powerful feature that checks names and bank details before payments are made.

At the time, we knew CoP had the potential to reduce misdirected payments and tackle fraud. Now, we are sharing an update on progress made and the benefits we have realised.

What is Confirmation of Payee?

CoP helps prevent misdirected payments by confirming a payee’s name, sort code and account number before money is sent to UK-based accounts. By using CoP, public sector customers setting up a new payee (or changing details of an existing one) receive instant results, allowing them to investigate and correct errors before a payment is made.

By offering CoP as a standalone feature, customers can onboard to ScotPayments solely for CoP verification, without processing payments through the platform. This has opened up new opportunities for fraud prevention and efficiency across the public sector.

Timeline

Since launch, we have been working with customers to embed CoP into their processes. So far:

- 8 customers onboarded

- 15,578 CoP checks completed

Each check represents a moment where money could have gone to the wrong account. With thousands of checks complete, the ScotPayments team have been able to move beyond implementation and turn the data into insights.

What benefits have we seen?

By ‘benefits’, we mean the positive impact for customers using CoP through ScotPayments. The key benefits being:

- Fewer returned payments, reducing the amount of error

- Time saved by avoiding investigations into failed payments

- Highlighting potential instances of fraud

One partner regularly sets up new payees. Before CoP, these payments risked errors. Now, they run CoP checks on all new details prior to sending money which has resulted in a 100% reduction in returned payments from Aug-Dec 2024 compared to the same period in 2023. We anticipate this trend will continue as this has remained consistent over a longer period.

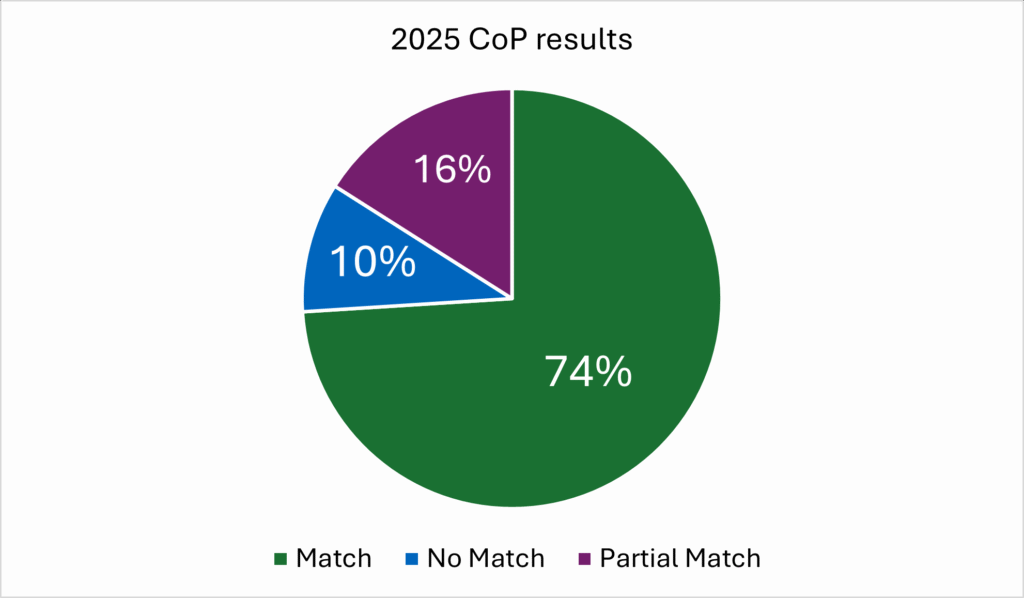

Across 2025 so far, roughly 10% of CoP checks have flagged a mismatch (‘No Match’ result). The chart below shows the breakdown for checks performed this year:

These figures have stayed consistent since CoP was introduced and as we gradually onboarded new customers.

Most benefits lie within the 10% of checks that returned ‘No Match’ results. There are several reasons for a mismatch including:

- CoP is unable to check account name

- Account doesn’t exist

- Or there is further investigation needed

Of all the ‘No match’ results, 12% were because the account did not exist. Analysis indicates that by rectifying those payments (which would have been returned otherwise), roughly 60 hours of staff time has been saved in 2025 across our customers. As we onboard new customers in 2026, we anticipate this time saving will increase.

The data also indicates where fraud could occur if CoP checks had not been conducted. Roughly 5% of the total CoP checks conducted should trigger organisations to investigate potential fraud, particularly Authorised Push Payment (APP) fraud. For the wider context on fraud and Confirmation of Payee, UK Finance states:

‘The industry prevented £1.6 billion of fraud in 2020. It achieved this through sophisticated detection systems, initiatives like Confirmation of Payee and warnings at the point where the customer is about to make a payment.’

How does this support the Digital Strategy for Scotland?

Across government and the public sector, digital platforms, services and tools are being designed, built and used to improve how services are delivered creating an increase in sustainable digital public services. Underpinning this progress has been an increasing focus on collaboration and a greater focus on building re-usable solutions with best value across the sector.

By adopting ScotPayments and Confirmation of Payee (CoP), partner organisations directly benefit from this approach. ScotPayments provides a shared, secure platform that reduces duplication and delivers best value, while CoP offers a reusable fraud prevention solution that can be integrated into existing processes. Together, they enable collaboration across the public sector, improve trust in digital transactions, and align with the strategy’s vision for efficient, resilient, and user-focused services.

What’s next?

The ScotPayments team is working on several enhancements to the CoP feature alongside development of the payments platform:

- Expanding access to the wider public sector in Scotland

- Bulk checks for multiple payments at once

- API integration for seamless connectivity

Get in touch

Contact us at ScotPayments@gov.scot or visit ScotPayments – gov.scot to learn more about the service.

Tags: Confirmation of Payee, digital public services, digital transformation, platforms, ScotPayments

Leave a comment