Digital

ScotPayments Design in Action (Part 2: Inclusive Payments)

January 7, 2025 by Stewart Hamilton No Comments | Category ScotPayments, Service design, User-Centred Design

Blog by Ryan Bowler and Fiona MacLellan to highlight ScotPayments UCD team deep dive into Inclusive Payments and why payment choice matters.

Inclusive Payments

We shared a post previously which introduces our User-Centred Design team and our iterative design process. Here we are with part 2 in our Design in Action series, with more on our recent deep dive on Inclusive Payments. In this post we’ll share what we’ve learned so far about the challenges people can encounter when receiving or using money and why having payment choice matters.

User Research interviews, photography by Cal Marr

Our service makes payments to members of the public. It’s important for us to understand challenges people can face when they receive money from the public sector. We want to know more about how receiving money could be made more inclusive

In this blog, we want to explore what being unbanked means, explain what alternative payment methods are, and share examples of how third sector organisations are making inclusive payments, so that more people can have access to support.

Our early research into this vital area is around people having a choice in how they receive and use money. This choice helps them avoid personal compromise and helps us promote inclusivity around money.

Unbanked

The ScotPayments Service is in private beta, and the way we currently send money means that a person must have a bank account to receive that money. Nowadays, this is quite common practice. There are many things that require a bank account, such as receiving wages, paying a bill or subscribing to a service.

This does not mean everyone has a bank account or uses one. When a person does not have a bank account, they’re sometimes called unbanked. It means that they are financially excluded, and are unable to access certain financial services like:

- Credit cards

- Overdrafts

- Debit cards

- Loans

- ATMs

- Mortgages

According to a report by the Financial Conduct Authority around 1.1 million adults in the UK are unbanked. That’s 3% of the adult population in Scotland. Some groups are more adversely affected. People aged 18-25, some ethnic groups, and unemployed people are much less likely to have access to their own bank account.

People can face barriers to accessing a bank account, including if they do not have a fixed address, personal ID or access to technology. It might seem as though people becoming banked is the solution, however not everyone wants to be banked. Lacking trust, negative experiences or simply wanting to use another method of payment can be why a person decides not to be banked.

Regardless of whether it’s a personal choice or an access issue, not having a bank account can leave people in compromising situations. Especially if you require a bank account to receive the money you need to pay for necessities.

Therefore, when a bank account is not an option, payment choice plays a crucial role in preventing people being excluded. Let’s look at what payment choice is through alternative payment methods.

Alternative Payments

Alternative payments are methods that differ from traditional options like cash or debit cards. Some examples include:

- Voucher payments

- Text codes

- Central bank digital currency

- SIM card payments

- Food cards

- Pre-paid cards

- Tokens

This list isn’t exhaustive, but alternative payments provide more choices in how people access and use money. These solutions often emerge from challenges faced by individuals or entire countries. The following case studies show how some organisations have used different payment options. These have helped us better understand the importance of payment choice.

Letham4all

We spoke to Letham4all, a local working group focused on overcoming challenges in a cash-first approach to help people during the cost-of-living crisis.

Their solution included:

- Sending text codes via PayPoint to individuals with utility accounts. These codes could then be redeemed in shops for essentials such as heating and electricity.

- Providing prepaid cards that could be used in many local stores.

Some benefits and challenges emerged. These solutions reduced staff and volunteer workload, meaning the process was more streamlined. However, using PayPoint to distribute funds was a costly measure for the organisation.

Despite these challenges, the positives outweighed the drawbacks, demonstrating the effectiveness of this approach.

Citizen’s Advice Scotland

We spoke to Citizens Advice Scotland who were piloting methods to provide people experiencing a food emergency a choice of a shopping card, cash grant or both (depending on the bureau). The goal was to address immediate need while providing support to prevent future need.

Their solution included:

- Providing households with greater dignity and choice via shopping cards and cash grants than accessing a food bank.

- Providing holistic and money advice alongside this support, to prevent future hardship.

They also saw benefits and challenges to this approach. Purchasing vouchers individually and activating them one by one was time consuming, and bulk purchasing was not an option. However, it did provide people with dignity, without compromising how they purchased their food.

Receiving benefits through voucher payments

The Department for Work and Pensions within the UK Government have a service called Payment Exception Service. It allows a person to collect benefits or pensions without a bank account. The services use i-movo to provide alternative payment methods, which is also provided by Social Security Scotland.

Their solution includes:

- a payment card

- an email with a voucher code

- a text message with a voucher code

These can be used at post offices or PayPoint outlet to withdraw money.

What does this mean for ScotPayments?

ScotPayments has been designed to enable internal staff users to make payments securely. Every public sector organisation we work with will serve different areas of the public, with different needs. As our user base grows, so too will our need for inclusive payments. We’ll evolve and adapt as we scale.

ScotPayments is dedicated to building a government grade payments platform that is user-centred and inclusive. New partners will help us learn more about the different scenarios for inclusive payments, including support in a crisis and catering for the unbanked population.

While in our Private Beta phase, we still have a number of new features to design and build. Our roadmap includes Inclusive Payments. In our dedication to this goal to evolve, we set out to learn more about what’s currently working.

Key takeaway on inclusive payments

Public money is needed by many people in Scotland, some of whom will not have access to a bank account.

We have explained examples in this blog on how alternative payment methods are already required to deliver public money to meet diverse situations.

We hope this brief blog summarises why choice in payments can be the difference between exclusionary and inclusive experiences around money.

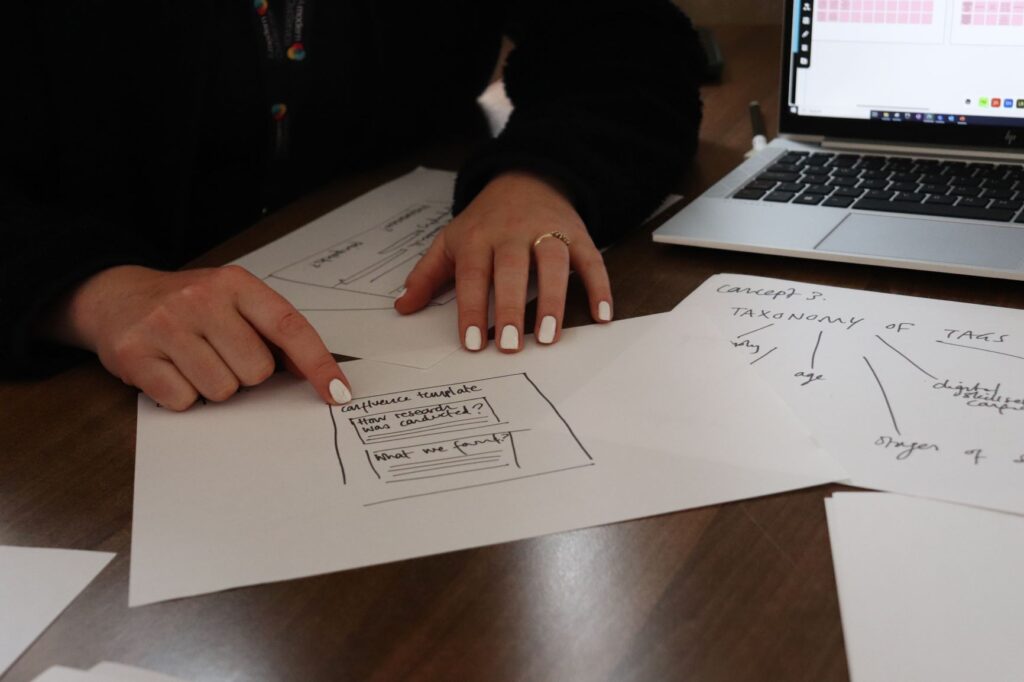

Design concepts from user insights, photography by Cal Mar

We’d like to give thanks to Letham4all and Citizens Advice Scotland for giving their time to support us in learning more about Inclusive Payments.

Thank you for reading. If you’d like to discuss more about the topics in this blog, please reach out: ScotPayments@Gov.Scot

In our next Design in Action series post, we’ll focus on our approach to accessibility testing.

Tags: ScotPayments, service design, User-centred design (UCD)

Leave a comment